Irs payroll tax calculator

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Federal Income TaxThe biggest tax of them all which can range from 0 all the way to 37.

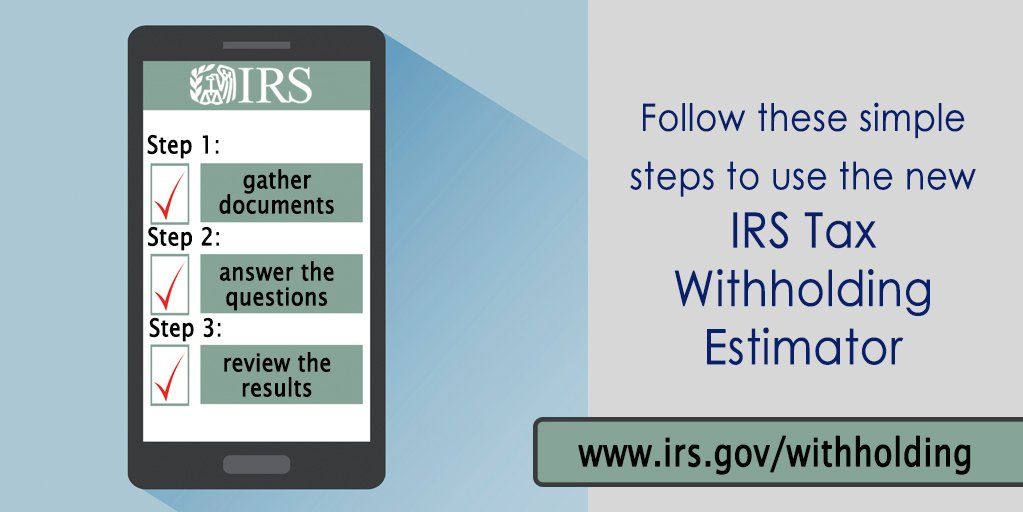

Irs Launches New Tax Withholding Estimator

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

. A Power of Attorney may be required for some Tax Audit Notice Services. Your tax situation is complex. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

So its no surprise that people in this situation often ask the IRS to remove or reduce their interest. The federal income tax withholding tables are included in Pub. WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help taxpayers check their 2018 tax withholding following passage of the Tax Cuts and Jobs Act in December.

Your household income location filing status and number of personal exemptions. How Do I Check My IRS Payment Plan Balance. They may also choose to make.

In addition to this most people pay taxes throughout the year in the. Checking your tax refund status online. 15-T Federal Income Tax Withholding Methods available at IRSgovPub15TYou may also use the Income Tax Withholding Assistant for Employers at IRSgovITWA to help you figure federal income tax withholding.

In prior years the IRS issued more than 9 out of 10 refunds to taxpayers in less than 21 days last year. But if you prefer to have more tax than necessary withheld from each paycheck you will get that money back as a refund when you file your tax return keep in mind though you do not earn interest on the amount you overpay. Ordering tax forms instructions and publications.

FICA Part 1 Social Security Tax. Withholding information can be found through the IRS Publication 15-T. Such as 401k or FSA accounts that are exempt from payroll tax.

We help you do payroll taxes right so that you can focus on growing your business. Just enter income and W-4 information for each employee and. Luckily our Florida payroll calculator is here to assist with calculating your federal withholding and any additional contributions your business is responsible for.

We designed a handy payroll tax calculator with you in mind. On how you fill out the state OR-W-4 and federal W-4 and sends them to the Oregon Department of Revenue and the IRS where its applied to your tax account. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA.

The tax system in the US works on a pay-as-you-go basis so the IRS collects income taxes throughout the year via payroll. Some employees may be responsible for court-ordered wage garnishments or child support. The IRS urges taxpayers to use these tools to make sure they have the right.

Individual taxpayers including TurboTax customers do not need a PTIN. However this transitional tool will no longer be available after 2022. We will then calculate the gross pay amount required to achieve your net paycheck.

Log into this app on the IRS website to see your total debt balance for each tax year and the last 18 months of your payment history. The amount of income tax your employer withholds from your regular pay depends on two things. 1 online tax filing solution for self-employed.

Subtract any post-tax deductions. However as a freelancer taxes are a little more complicated. While a 0 state income tax is saving you from some calculations you are still responsible for implementing federal payroll taxes.

Call 800-829-3676 to order prior-year forms and instructions. The amount you earn. The information you give your employer on Form W4.

The redesigned Form W-4 makes it easier for you to have your withholding match your tax liability. Tax Audit Notice Services include tax advice only. When you work at a job a part of your income is taken each pay period based on a number of factors including your total pay how often you get checks and how many allowances you take when you fill out your W-4 at the beginning of your time at the jobPayroll taxes can be.

You can get forms. On top of the tax bill the IRS charges penalties and interest. However the service only works at certain hours in the day and it takes a few weeks.

Ideally if you are a W-2 employee you automatically get your taxes withheld by your employer. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Payroll tax deductions are a part of the way income taxes are collected in the US.

We welcome your comments about this publication and suggestions for future editions. Payroll offices and human resource departments are responsible only for processing. If you e-filed your tax return using TurboTax you can check your e-file status online to ensure it was accepted.

You can use the Tax Withholding Estimator to estimate your 2020 income tax. See Florida tax rates. The same results are expected for 2021.

An IRS Preparer Tax Identification Number PTIN is a number issued by the IRS to a professional tax preparer such as Certified Public Accountants CPAs and Enrolled Agents EAs. Deduct these withholdings in order to come up with taxable income. Comments and suggestions.

Amended tax returns not included in flat fees. Americas 1 tax preparation provider. Dont resubmit requests youve already sent us.

Situations covered assuming no added tax complexity. Go to IRSgovOrderForms to order current forms instructions and publications. Only certain taxpayers are eligible.

If you have a simple tax return you can file with TurboTax Free Edition TurboTax Live Basic or TurboTax Live Full Service Basic. Only the IRS knows the status of processing your tax return whether you owe taxes or are due a refund. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

This includes alternative minimum tax long-term capital gains or qualified dividends. Once you are accepted you are on the IRS payment timetable. Luckily thats what were here for.

You have nonresident alien status. Estimate your tax withholding with the new Form W-4P. Consult your own attorney for legal advice.

Nearly all working Americans are required to file a tax return with the IRS each year. See Publication 505 Tax Withholding and Estimated Tax. A separate agreement is required for all Tax Audit Notice Services.

As your balance grows so does the interest. For help with your withholding you may use the Tax Withholding Estimator. Heres the IRS rule of thumb.

A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Wait at least three days after e-filing your tax return before checking a refund status.

The IRS will process your order for forms and publications as soon as possible. IR-2018-36 February 28 2018. FICA Part 2 Medicare Tax.

Oregon personal income tax withholding and calculator Currently selected. NW IR-6526 Washington DC 20224. A PTIN is only required for professional tax preparers that accept payment to prepare tax returns.

If you have filed a return every year reported all your income and done nothing fraudulent keep tax records for three years. Comparison based on paper check mailed from the IRS. Choose your state below to find a state-specific payroll calculator check 2022 tax rates and other local information.

There is another online method to check your IRS payment plan balance and other tax details. Self-Employed defined as a return with a Schedule CC-EZ tax form. Thats why its critical to get into a payment agreement with the IRS.

When you e-file your tax return to the IRS it needs approximately three days to update your information on the website. We wont go into all the nitty-gritty details here. People who owe the IRS owe more than taxes.

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

Calculation Of Federal Employment Taxes Payroll Services

Tax Withholding For Pensions And Social Security Sensible Money

How To Calculate Federal Income Tax

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate Federal Income Tax

Calculating Federal Income Tax Withholding Youtube

Payroll Tax What It Is How To Calculate It Bench Accounting

Tax Withholding Estimator New Free 2019 2020 Irs Youtube

Irs Improves Online Tax Withholding Calculator

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network

Payroll Tax Calculator For Employers Gusto

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

Irs Launches New Tax Withholding Estimator Redesigned Online Tool Makes It Easier To Do A Paycheck Checkup Where S My Refund Tax News Information

Nvai7b73uqmw5m

Calculation Of Federal Employment Taxes Payroll Services